This is a comprehensive guide on how to get school bus conversion insurance based on months of research and the process of getting insurance for our skoolie. From getting insurance for a new bus you just purchased to cover yourself when you drive it home, to getting full coverage skoolie insurance when you are finished with your school bus conversion.

We’ll go through:

- School Bus Conversion Insurance Myths

- 6 types of Skoolie Insurance Coverage

- 5 Types of Skoolie Insurance Policies

- Tips for Getting Insurance for a Skoolie

Getting skoolie insurance can frustrating, especially if you are just buying a bus for the first time or you are in the conversion process. Our goal with this guide is to provide as much detail as possible on the process so you can navigate your way to getting insurance from raw bus to finished skoolie.

Legal Notice: What we are about to share in not insurance or legal advice it is simply what we learned from going through the process of obtaining insurance, how we found others getting insurance, and what we did to get coverage. This is only to be used for educational purposes only. We highly advise you to do your own research and seek insurance and/or legal counsel of your own to ensure you are fully covered driving your bus home and during your conversion process.

School Bus Conversion Insurance Myths

There are many old skoolie insurance articles and forum posts out there about how to get school bus conversion insurance (or those struggling with it) which made both Sarah and I nervous about insurance when we first got started.

Fortunately, it is not as hard as they say. Most people will get rejected or run into a road block a few times, then get frustrated – turning to forums and blog posts to let everyone know what they are experiencing. We get their frustration – Progressive dropped us from our policy 75% through our conversion process.

Myth 1: Raw Bus, Conversion, and Finished Skoolie Insurance is hard to get.

The industry has moved forward and there are many different ways to get insurance beyond the big companies out there when buying a used school bus and during the conversion process.

State Farm and other companies have come a long way to offering full coverage school bus conversion insurance once the conversion is complete. (Varies state to state.)

Myth 2: Raw Bus, During Conversion, and Finished Skoolie Insurance is expensive.

Insurance for purchasing a raw bus and while doing the conversion is not expensive at all, depending on how you communicate your intentions with the bus while you have the policy.

Insurance for a skoolie once complete is also not expensive, because at this point it is categorized by some companies as a regular RV – especially if the title has been changed to classify it as a motorhome.

With that out of the way, let’s dive a bit further into the types of insurance you will want to get throughout the conversion process, then once you finish your skoolie and begin traveling.

6 Types of Insurance Coverages Explained

There are eight types of insurance coverage that you should know about when determining which insurance is right for your situation:

- Liability Insurance: Liability insurance covers damages and injuries caused by the driver of the vehicle to other people and their property when the driver of the skoolie is at fault. Liability insurance is essential for anyone who owns a vehicle and is usually required by law in most states.

- Comprehensive Insurance: Comprehensive insurance covers damage to your skoolie that is not caused by a collision with another vehicle. This could include damage from a fire, theft, damage from storms, or vandalism property damage. It is not typically required by law, but may be a good idea depending on the value of your skoolie.

- Collision Insurance: Collision insurance covers damage to your skoolie that is caused by a collision with another vehicle or object. It is also not typically required by law, but may be a good idea depending on the value of your skoolie.

- Roadside Assistance Plan: Roadside assistance is usually an add-on coverage plan to an insurance policy to cover come of the costs that one may encounter when traveling including engine issues or a flat tire that forced you to stop on the side of the road.

- Personal Property Insurance: Personal property insurance covers the contents of your skoolie, including any furniture, electronics, or other personal belongings. This insurance is not typically required, but may be a good idea to ensure personal items coverage.

- Travel Insurance: Travel insurance can cover the cost of medical treatment, emergency medical transportation, and other expenses that may arise while you’re on the road.

It’s important to note that insurance requirements and availability can vary by state and by insurance company and your needs.

When insuring a skoolie, personal possessions, and yourself – it is a good idea to speak with an insurance agent who specializes in RV or commercial vehicle insurance, travel insurance, and personal property insurance to make sure you have the coverage you need. Often times, different policies may be needed to cover different situations and some overlap in coverage may occur, which is not always a bad thing to have double coverage for different items.

5 Types of Skoolie Insurance Policies

There are five main types of insurance you will want to get through the process of buying a school bus all the way to when you begin traveling and beyond, which are:

- Commercial Vehicle Insurance for Personal Use: Commercial vehicle insurance for personal use is a type of insurance policy that provides coverage for vehicles that are owned or used by an individual for personal use but are classified as commercial vehicles.

- Part-Time RV Insurance: Part-time RV insurance typically includes liability coverage, collision coverage, and comprehensive coverage. Part-time RV insurance is a type of insurance policy designed for people who own and use a recreational vehicle (RV) on a part-time basis. This type of insurance is meant for individuals who do not use their RV as their primary residence, but rather use it for occasional vacations, weekend trips, or other leisure activities.

- Full-Time RV Insurance: Full-time RV insurance is designed for people who live in their vehicles full-time. Full-Time RV Insurance includes liability, comprehensive, and collision insurance with some additional coverage for things like towing, emergency expenses, and personal liability.

- Travel Insurance: Travel insurance is generally a type of insurance policy that provides coverage for unexpected events that may occur while traveling. For a skoolie owner, this type of insurance can help protect themselves and passengers while they are on the road, and it can provide coverage for a variety of situations which may include trip cancellation costs, emergency medical, personal property, roadside assistance, and additional liability coverages.

- Renters Insurance: If you plan to rent out your skoolie or use it as a temporary dwelling, you may want to consider purchasing renters insurance to cover your personal possessions. Renters insurance can protect your belongings from damage or theft while they are in the skoolie. However, you may need additional liability coverage specifically designed for renting out your skoolie, if you decide to make it a Skoolie BnB.

You DO NOT need all 5 of these at one time.

In this article we focus on insurance specifically for the skoolie, which includes:

- Commercial Vehicle Insurance for Personal Use

- Part-Time RV Insurance

- Full-Time RV Insurance

Both Travel Insurance and Renters Insurance are additional insurance coverages that can be obtained to further cover medical emergency and personal possessions beyond what the three insurance types for a skoolie may cover.

What is Bus Conversion Insurance?

Bus conversion insurance is the insurance policy during the purchase, initial drive to the conversion location, and during the build process of a skoolie. Bus conversion insurance is a skoolie community term and not an official name for a type of insurance. Most bus conversion insurance held is a commercial vehicle for personal use policy.

A school bus or a shuttle bus is a commercial vehicle until the title is changed to classifying it as a motorhome. Since these are classified as commercial vehicles, insurance companies generally require commercial vehicle insurance policies even though we plan on using them for personal use.

Once the bus has been converted, the commercial vehicle insurance for personal use policy can be replaced with getting Part-Time or Full-Time RV Insurance.

Commercial Vehicle Insurance for Personal Use

In this section we dive deeper into the first policy most people buying a raw bus to convert get which is a commercial vehicle insurance policy. This is essentially raw school bus insurance since the raw bus is still considered a commercial vehicle until the conversion is complete.

If you have or plan on purchasing a finished skoolie, you can skip down to where we cover Full Coverage Skoolie Insurance.

What is Commercial Vehicle Insurance for Personal Use?

Commercial vehicle insurance for personal use is a type of insurance policy that provides general liability coverage for vehicles that are owned or used by an individual for personal use but are classified as commercial vehicles.

When first buying a used school bus and driving it home, you will need to have at least liability coverage. This covers the other people and their property if you were to get into an accident. Most states require liability coverage on a vehicle.

Adding comprehensive and collision insurance to the policy would be a good idea to at least cover the bus if you are in an accident. This will protect your investment, as liability coverage only protects the other person and their property.

How Long is Commercial Vehicle Personal Use Insurance on a Skoolie Needed?

An owner of a newly purchased bus that is to be converted into a skoolie should consider at least having a commercial vehicle insurance for personal use policy to cover the drive from the point of purchase to where the vehicle will be parked during the conversion.

If you plan on driving the bus from time to time during the build process, it would be a good idea to keep this coverage. As previously mentioned, you may also want to get comprehensive of collision insurance included with the policy to protect your investment into the bus.

This is what is often referred to as “bus conversion insurance.”

How to Get a Personal Use Commercial Vehicle Policy on a Skoolie

There are two options for getting a policy when the bus is still considered a commercial vehicle.

- Call a regular vehicle insurance agent.

- Call commercial insurance agents directly.

1. Call a Regular Vehicle Insurance Agent

The first step is talking with your current vehicle insurance provider, especially if you have an independent insurance agent that you know and have worked with before. If you don’t have vehicle insurance, call around and talk with different regular vehicle insurance agents.

When calling a regular vehicle insurance agent, begin with explaining to them you are not a business but you are purchasing a commercial vehicle to use as a personal vehicle. Essentially, you want personal use insurance on a commercial vehicle. They may be able to help you with a policy or direct you to someone who can talk to you about a policy for this situation.

How far you get with these agents depend on the agent you are working with – their experience, knowledge, and willingness to work with your situation that is different than their typical personal vehicles they generally working with clients on. It can sometimes be better to work with an independent agent who can source quotes from several different insurance companies for you.

2. Call Commercial Insurance Agent Directly

The next step is to call commercial insurance vehicle providers directly to see if you can get a commercial vehicle policy. Generally, you will need a business and the vehicle would need to be used for commercial purposes to get a commercial vehicle policy. However, we ended up with a commercial policy that was really cheap.

How We Got Commercial Vehicle Insurance for Personal Use

We called the regular personal vehicle insurance number at Progressive and told them we would like to add a commercial vehicle for personal use on our existing policy. I (Chris) have had Progressive insurance on my cars and motorcycles for 10+ years. When asked, we said we were buying the bus to store some stuff in it on some family property. This was not a lie, as for several months of the build it was basically a storage unit of wood, tools, and all of our build supply.

Progressive transferred us to their commercial insurance department, where we were asked about the bus and again about our plan with the bus. We ended up getting a commercial vehicle policy, but right on it stated the policy was for a commercial vehicle being used for personal use. Our policy was also mileage limited to a radius of 100 miles from the policy address.

We made sure on the phone that the policy would cover the initial ride (about 500 miles) home to Wisconsin from where we were purchasing it in mid-southern Michigan. The agent confirmed and stated she added a note to our policy about the initial drive, with the location of purchase and policy address as the destination and the dates of travel. We gave them a span of a few days to travel just to be safe.

How Much Does a Commercial Vehicle Insurance for Personal Use Policy Cost?

Commercial vehicle insurance for personal use policies should be 6 month policies that cost anywhere from $200 to $600 per 6 month term. The cost generally depends on the type, age, mileage, and expected driving radius from the main point of storage.

Our policy ended up costing around $260 every six months and we had it for two 6 month terms, which overlapped a few months of our full-coverage RV insurance with State Farm. The policy we had restricted us to a driving radius of 130 miles from our parking location where the bus was stored, which was enough for us during the conversion process to take short drives so the bus did not remain parked all of the time.

How to Get Full Coverage Skoolie Insurance

Once your skoolie is finished, you can ditch the commercial vehicle insurance policy and move onto getting full-coverage insurance that will cover the bus, everything you invested into the build, and even personal possessions. This is basically regular RV insurance covering liability, comprehensive, and collision insurance.

However, there are a few extra steps us skoolie owners need to go through during the insurance underwriting process to be able to get insurance. The one requirement is that the skoolie is finished.

Types of Insurance for Finished Skoolies

The two types of insurance for finished skoolies are full-time RV insurance and part-time RV insurance.

Full-Time RV Insurance for Skoolies

A full-time RV insurance policy covers the skoolie when living full-time on the road with no other location being used as a primary residence. Full-time RV insurance policies generally includes liability, collision, and comprehensive insurance.

Full-time RV insurance will cost more than part-time RV insurance as there is inherently more risk of a person with all of their possessions living full-time in the RV compared to someone traveling part-time with most of their possessions remaining in their primary residence.

Recreational Only, Part-Time RV Insurance for Skoolies

A Part-Time RV Insurance Policy, also known as a Recreational Only RV Insurance Policy, covers the skoolie when the owner has a primary residence with a permanent address. The owner is only looking to travel recreationally, part-time in the skoolie. Part-time RV insurance policies generally include liability, collision, and comprehensive insurance with the cost of the policy being based on the amount of time and/or mileage traveled.

What is Required to Full Coverage Insurance on a Skoolie?

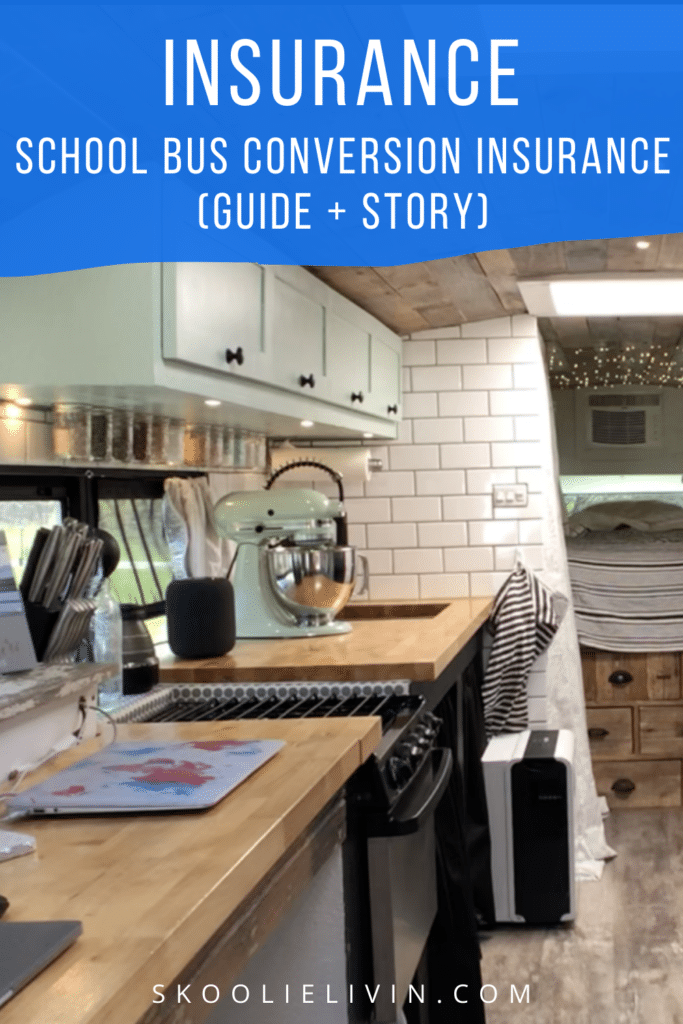

- The skoolie is near completion: The process to get full-time or part-time RV insurance on a skoolie can begin once the exterior meets the requirements of the state it is being registered and the interior is near completion.

- The skoolie is titled and registered as a motorhome: Insurance companies will require and the school bus to be titled as a motorhome. To get a skoolie titled and registered as a motorhome, most states require certain standard amenities to be in place such as a bed or place to sleep, drinkable water supply, a bathroom, a power supply for standard 110v to 125v power supply, a heating system, a place to prepare and cook food, and potentially an air conditioning or ventilation system.

- Documentation of the construction: Some insurance companies, particularly the underwriters, will want to ensure the construction is professionally done or of professional quality. Having pictures or video from during the build process can help in this review if it is required by the insurance company.

- Documentation of the build costs: When seeking comprehensive and collision insurance to cover the entire value of what is invested in the skoolie, the insurance company may request documentation of the invested build costs. Having receipts and cost documentation can help expedite this coverage valuation review.

- Honest and transparency: Being honest with the insurance agent of that it is a converted school bus will ensure that there is no risk of the insurance provider not covering a claim due to them making a claim that they did not know it was a school bus conversion.

- Pictures of the skoolie: Insurance providers will want pictures of specific angles including the VIN number, engine, bathroom facilities, interior view from the front to back, interior view from the back to front, and potentially other specific items. These pictures help in the approval and underwriting process of the insurance policy, while also ensuring they completely understand what they are insuring.

- Mechanical Inspection: A mechanical bus inspection may be requested by an insurance agency to ensure the bus is in working order. Mechanical inspections are another way the insurance companies can validate they know exactly what they are insuring.

- Safety Inspection: Not every insurance agency will require a safety inspection, but some may request a safety inspection on the finished skoolie is performed if it was not converted by a professional.

What Insurance Companies Will Insure a Skoolie?

Non-professional bus conversion or self-converted skoolie owners should try contacting State Farm and National General.

Professional conversion skoolie owners should contact State Farm and National General, while also trying Good Sam and RVInsurance.com – which are National General affiliate companies.

Allstate has stopped providing new policies on skoolies. Progressive has stopped providing new policies on skoolies and have also been dropping existing policies.

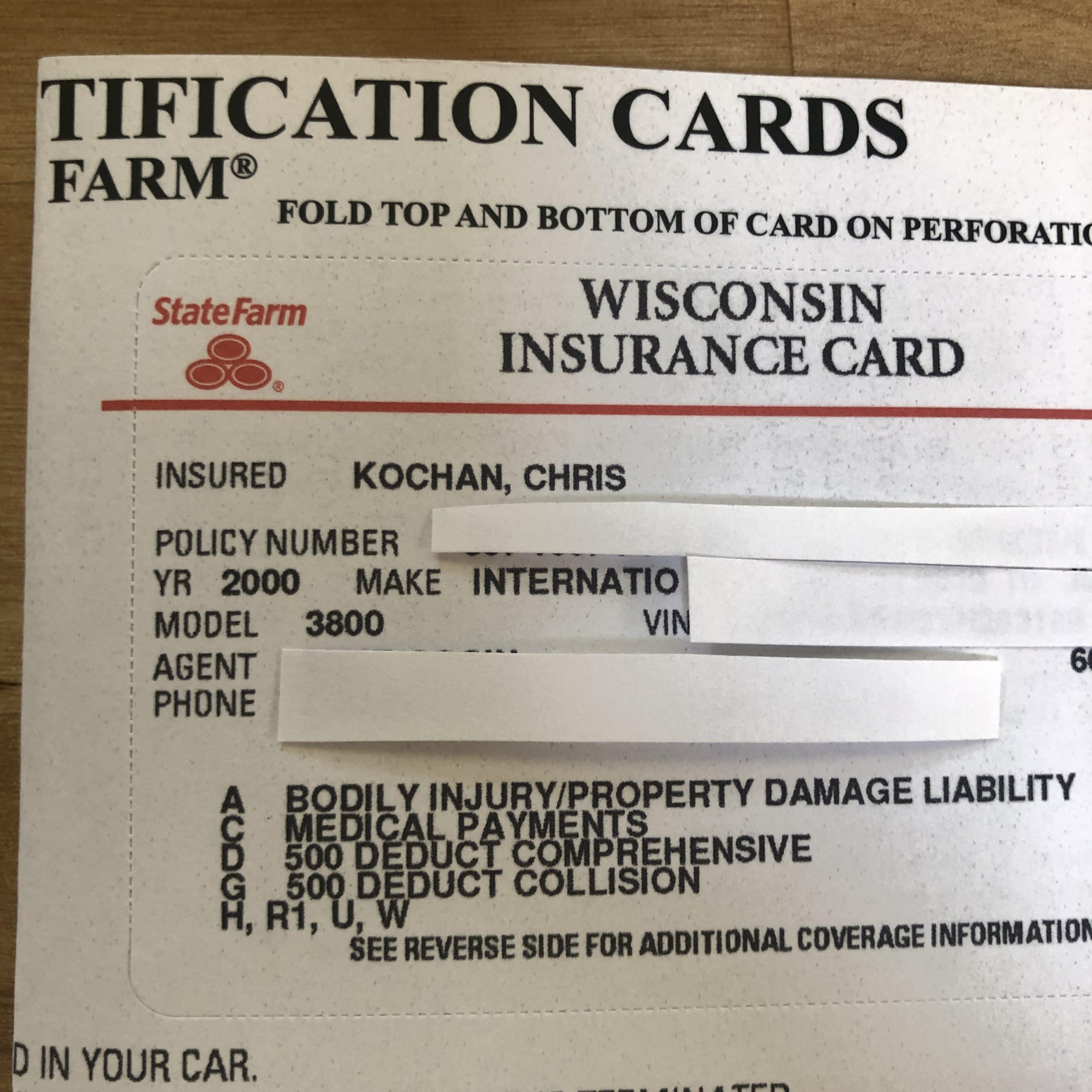

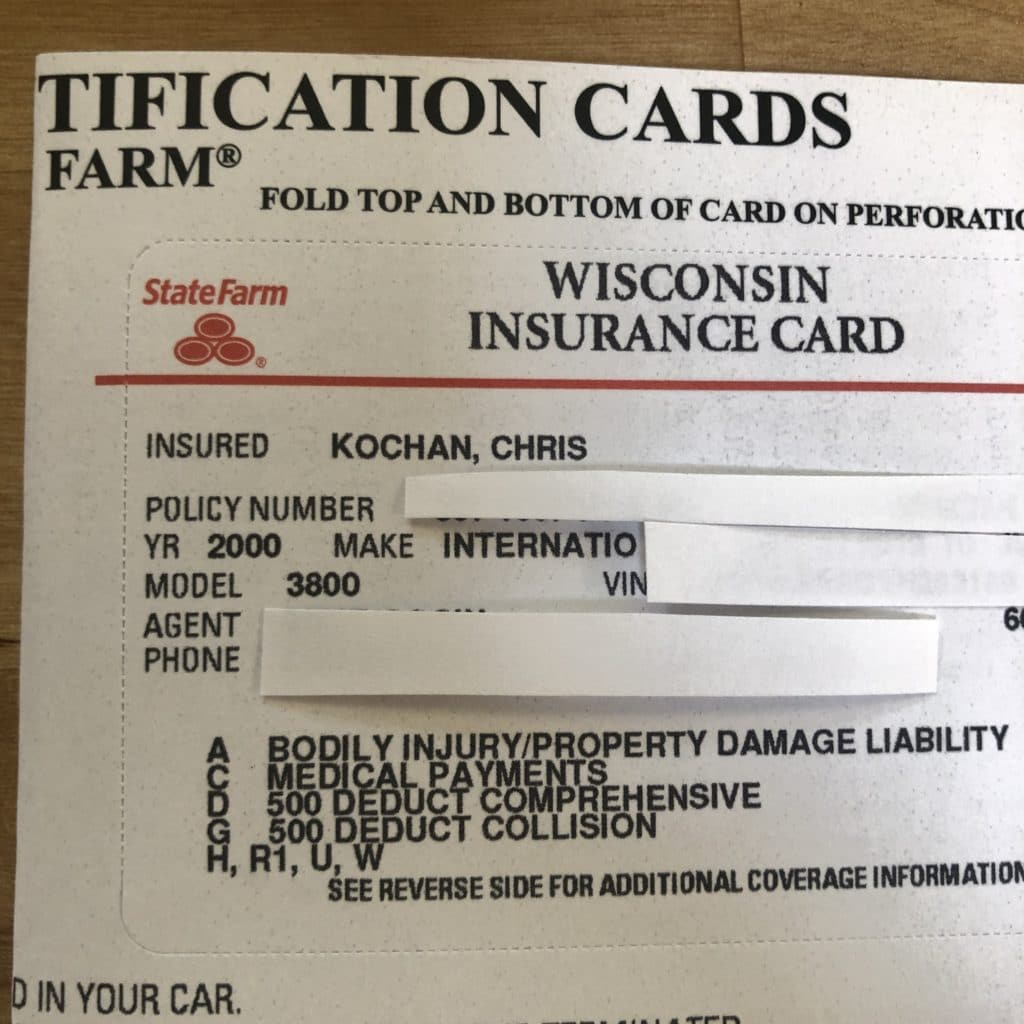

How We Got State Farm Skoolie Insurance

This is the story of how we initially got part-time RV insurance for our skoolie. Keep in mind that back in 2018 skoolies were less common than they are today.

We went with part-time RV insurance as we knew we would be parked on family property and traveling limited miles as we worked to get ahead financially.

We were extremely nervous about getting insurance on our skoolie, mostly due to the number of posts and articles we read about the difficulty of getting insurance. It was the one thing out of the entire conversion process that I (Chris) dreaded the most.

We were so focused on not getting denied by the insurance provider that when we started working with the insurance agent we we weren’t 100% transparent of what our vehicle actually was – a school bus converted into a motorhome.

Here is how that went down…

We started the process by submitting the contact form to send an email to our local State Farm office. After a few emails of higher-level conversation, I got on a phone call with the insurance agent to discuss some of the details about what coverages we were looking for with our insurance so we could get an accurate quote.

During the conversation, I recognized the guy’s last name. It was the same last name of an old neighbor when I was in high school. I asked if he knew the guy (my old neighbor). It turns out it was his son who was a few years younger than me. Small world!

I still played it cautiously, but was a bit more honest while staying on the topic that it was a conversion and we just had ‘rebuilt the motorhome’. I also did tell him it was a 2000 International 3800 and all the other details. I did not mention it was a “school bus” once during the conversation, though.

We get off the phone and not even an hour later I get another call.

“Hey Chris, so I was looking up the model and it wasn’t in our system under motorhomes. So I went to Google and searched – is this an old school bus, like a party bus?”

He got me!

“Yeah… it’s an old school bus we converted and turned into a motorhome. We have it retitled with the DMV as a motorhome and all the facilities are in it, so it is technically now a legit motorhome now.”

Long story short, he called the underwriter to explain the situation and that it wasn’t a school bus anymore. It was a fully converted motorhome. The underwriter simply asked for specific pictures to attach along with the file so they could see that it was indeed a motorhome and what they were insuring.

We sent in about 15-20 photos in total, from pictures of the VIN, to the engine bay, to the bathroom facilities, etc. The number of pictures we needed to take were due to wanting full coverage for all of the money invested into the conversion. The exterior was about 80% done and the interior was about the same. From the pictures, the underwriter would never really know if the bus was done or not, besides some pictures had plywood flooring, no cushions on the couch, etc.

If you are looking to have you skoolie fully insured, I would highly recommend having the conversion look 100% complete with everything you want insured installed into your conversion. If there are some minor details not complete, you should be good.

Why I am telling this story is to hopefully inspire you to not do what I did and try to hold back, but be overly honest with the insurance agent. Had he not questioned me or took a deeper look, there is a chance we would be paying for insurance that could be void when making a claim due to them not knowing exactly what they were insuring.

Be honest with the agent, send TOO MANY pictures to ensure they have all the documentation, and make sure they know exactly what they are insuring. The point of insurance is not to check a box so you can go out and travel. Insurance is to ensure you are covered to exposures financially and medically in the unfortunate event that you are involved in an accident.

It is for your safety and protection. Not being honest gives the insurance company gives exposure to insurance claims not being accepted if something were to unfortunately happen.

Hi. I discovered your site last fall and have been reading everything I can find about about school bus conversions. I had a plan to do this back in 1977. I was 12 years old and mad my mother was getting rid of the piano. My best friend and I decided we would live in a bus and put the piano in the back- a full size upright antique player piano! That never happened. My mother was a school bus driver for years so I did grow up in a bus. I have wanted to do this for so long and I almost have my husband “on board” ! My question- Do you know anyone who has done this and has their schoolie registered in Massachusetts? I’ve read that it’s the hardest state to do this because the state doesn’t like it. They also don’t want tiny homes. Any advice for MA residents? Thanks!

My research is indicating Vermont will register conversion bus even if you are not a resident…

It’s helpful that you mentioned that having an idea about the distance to be traveled each year will help in getting insurance for used school buses. I think such a vehicles would be perfect for long road trips. I dream about going on an interstate trip with my niece and nephew someday because we always like going on adventures together whenever my sister allows me to spend time with them.

What do you pay now for full coverage? In Wisconsin as well and about to buy our first bus now to convert.

Thanks, Tony

Hi Tony,

We pay around $400 per year. The cost will depend on how much you choose to insure it for and your policy limits.

What company do you go through?

We are insured through State Farm.

This was SO helpful! Purchased my bus AND got it insured all in the same day thanks to this page!

I am in Wisconsin as well. Did you try to get full coverage thru Progressive? TIA

Hi Shelley, we did try. We were insured through Progressive during the build stage of our conversion. But when we finished our build and was looking for full coverage, Progressive denied us and could only offer us liability insurance. That’s when we went with State Farm as they were able to give us full coverage.

Hi As of June 2021 is State Farm still insuring school conversions. Progressive and Allstate do no do them any more?? Need to find someone in NY

Hi John, State Farm is still be insuring skoolie conversions, as that is who we are still insured with today. Progressive would not insure us and we did not personally reach out to Allstate to see if they would.